Debt Obligation

The following documents contain information regarding Tarrant County's debt obligations and its ability to be fiduciarily responsible.

- Historical Trend of Total Outstanding Tax Supported Debt

- Historical Trend of Total Outstanding Tax Supported Debt PDF

- Combined Schedule of Tarrant County's Outstanding Debt

- Combined Schedule of Tarrant County's Outstanding Debt PDF

- Issue by Issue Listing, Including Principal Amount of Each Outstanding Debt Obligation

- Issue by Issue Listing, Including Principal Amount of Each Outstanding Debt Obligation PDF

- Annual Local Debt Report

- Annual Local Debt Report PDF

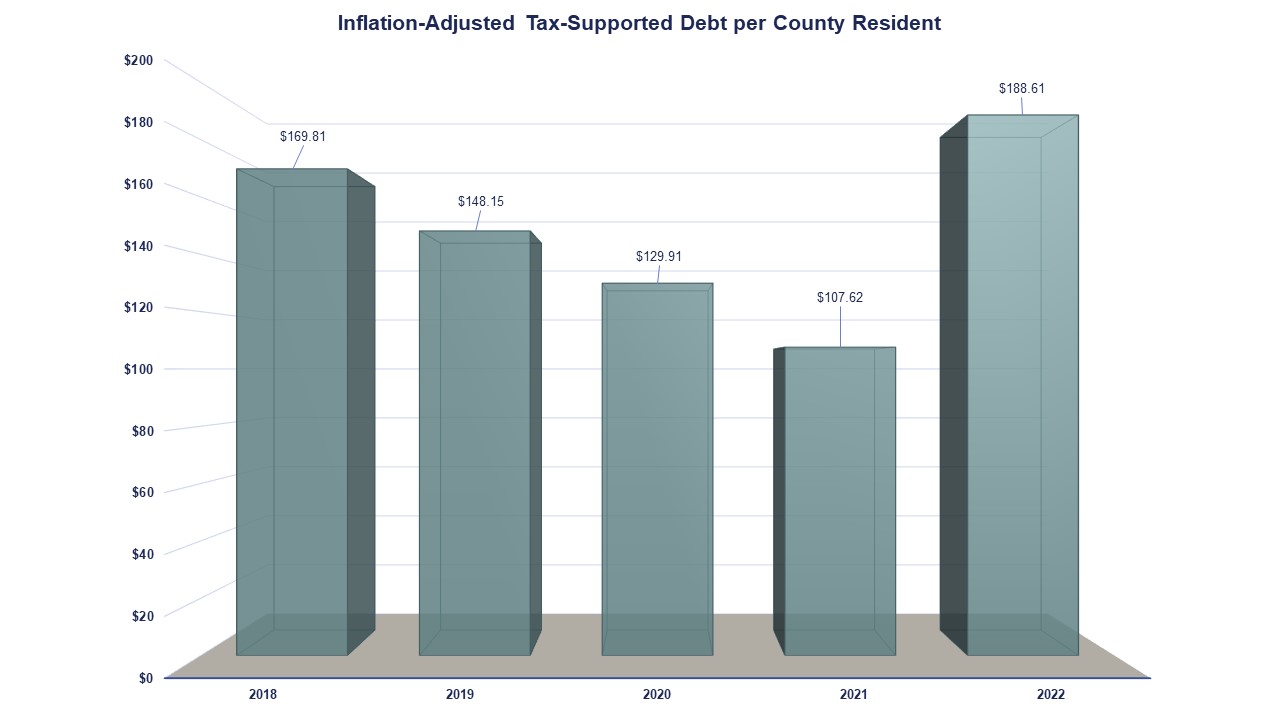

Population numbers based on North Central Texas Council of Governments Population Estimates

CPI Inflation based on Bureau of Labor Statistics Calculator

* Includes lease purchase obligations

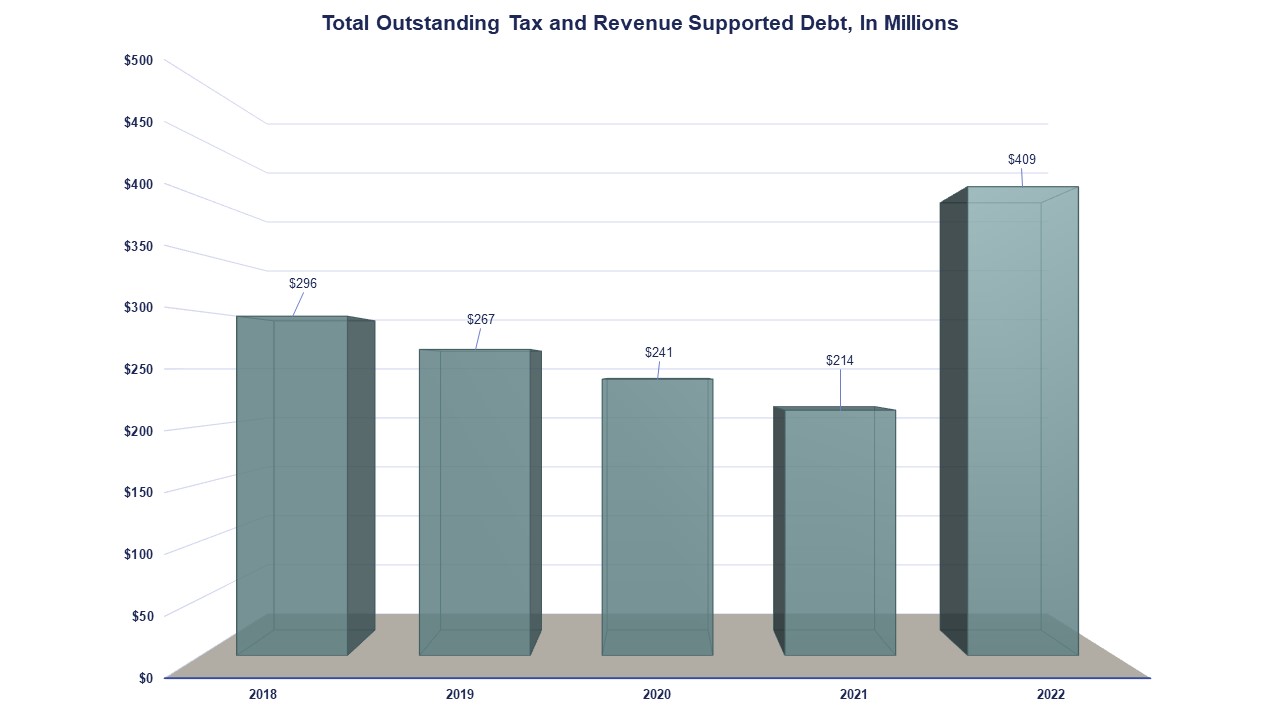

Total Outstanding Debt

Tarrant County’s total outstanding tax supported debt as of September 30, 2022 is $409,467,000. The County does not have revenue supported debt. The County's leases outstanding is $5,107,000. The tax supported debt obligation per county resident is $164.80.

Bonds are generally issued as 20-year serial bonds. Payments are scheduled through 2035.

Debt Summary Charts

Sept. 30, 2022 |

Sept. 30, 2021 |

Sept. 30, 2020 |

Sept. 30, 2019 |

Sept. 30, 2018 |

|

Ltd Tax Ref & Impr Bonds Ser 2010 |

1,805,000 |

3,520,000 |

7,690,000 |

11,655,000 |

|

Ltd Tax Ref & Impr Bonds Ser 2013 |

5,235,000 |

37,870,000 |

42,610,000 |

47,120,000 |

52,630,000 |

Ltd Tax Ref & Impr Bonds Ser 2015 |

9,890,000 |

56,340,000 |

59,185,000 |

61,895,000 |

64,475,000 |

Ltd Tax Ref & Impr Bonds Ser 2015A |

31,040,000 |

39,215,000 |

47,235,000 |

55,095,000 |

63,205,000 |

Ltd Tax Ref Bonds Ser 2016 |

40,095,000 |

46,440,000 |

52,690,000 |

58,855,000 |

66,310,000 |

Ltd Tax Ref Bonds Ser 2017 |

28,740,000 |

32,005,000 |

35,205,000 |

35,720,000 |

36,225,000 |

Ltd Tax Ref Bonds Ser 2022A |

28,675,000 |

||||

Ltd Tax Ref Bonds Ser 2022B |

45,780,000 |

||||

Ltd Tax Bonds Ser 2022 |

214,905,000 |

||||

Total as of FYE |

404,360,000 |

213,675,000 |

240,445,000 |

266,375,000 |

294,500,000 |

Total Ltd Tax Bond |

Capital Leases |

Total Outstanding Debt |

|

2022 |

404,360,000 |

5,107,000 |

409,467,000 |

2021 |

213,675,000 |

38,000 |

213,713,000 |

2020 |

240,445,000 |

71,000 |

240,516,000 |

2019 |

266,375,000 |

857,000 |

267,232,000 |

2018 |

294,500,000 |

1,641,000 |

296,141,000 |

Bond Elections

The two most recent Tarrant County bond elections occurred in 1998 and 2006. There are no upcoming bond elections.

1998

On August 8, 1998, Tarrant County voters approved G.O. Bond funding for three separate capital improvement projects totaling $94,300,000. The capital improvement projects included the construction of a new Family Law Courthouse, the addition of a County public health facility, and expansion of the County’s jail facilities.

Bond Proposition |

Amount Authorized |

Amount Issued |

Unissued Balance |

Family Law Center |

$70,600,000 |

$63,100,000 |

$7,500,000 |

Public Health Facility |

$9,100,000 |

$1,000,000 |

$8,100,000 |

County Jail Facilities |

$14,600,000 |

$14,600,000 |

$0 |

Total |

$94,300,000 |

$78,700,000 |

$15,600,000 |

At this time, there is no intent to sell the balance associated with these bond authorizations.

The Family Law Courthouse provides specially designed courtrooms, conferencing areas, and children’s waiting rooms. A new County public health facility was proposed to enhance the program operations by providing sufficient training and classroom space for health promotion activities. Other sources of funds were also used to complete this project. The expansion of the County’s jail facilities included 1,100 additional beds.

2006

On May 13, 2006, Tarrant County voters approved G.O. Bond funding up to $433,120,000 in capital improvement and transportation projects designed to meet the needs of one of Texas’ fastest growing counties.

Bond Proposition |

Amount Authorized |

Amount Issued |

Unissued Balance |

Roads & Bridges |

$200,000,000 |

$200,000,000 |

$0 |

Jail Facilities |

$108,000,000 |

$93,000,000 |

$15,000,000* |

Court Buildings |

$62,300,000 |

$62,300,000 |

$0 |

Juvenile Justice Complex |

$36,320,000 |

$36,320,000 |

$0 |

Medical Examiner Facilities |

$26,500,000 |

$26,500,000 |

$0 |

Total |

$433,120,000 |

$418,120,000 |

$15,000,000 |

*Reallocated $15 million from court buildings to jail facilities.

Obsolete and overcrowded facilities are being renovated or replaced with newer facilities to handle future growth. Voters approved five separate proposals, four of which involve capital improvement projects. Those projects include improvements to the County and District Court (Civil Courts) buildings, the Juvenile Justice Complex, the Medical Examiner’s facilities, and County jail facilities. The remaining proposal addresses the county’s transportation needs and includes mobility, street, road, highway and bridge maintenance, and improvement projects.

Definitions

- General Obligation Bonds (G.O. Bonds) are secured by the County’s ad valorem taxes. Tarrant County issues G.O. Bonds with voter approval following a bond election.

- Limited Tax Bonds can be issued by the County, under Article III, Section 52, of the Texas Constitution. These bonds are secured by pledging a percentage of the property taxes. The debt amount must not exceed 25 percent of the County’s total appraised taxable valuation.

- Refunding Bonds can be issued by the County, under Chapter 1207, Texas Government Code, to refinance outstanding bonds by issuing new bonds at a lower interest rate. Refunding Bonds do not require an election.

- Lease-Purchase Bonds involve the purchase of an asset through periodic lease payments.

Accessibility Notice: If you need assistance accessing the preceding information, please contact the County Administrator's Office at 817-884-1575.

TARRANT COUNTY, TX

TARRANT COUNTY, TX

OpenBooks

OpenBooks